reit dividend tax rate

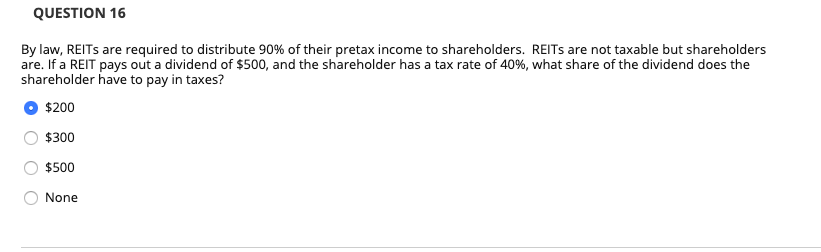

According to regulations at least 90 of profits from a REITs property rental business has to be. This provision qualified business income effectively.

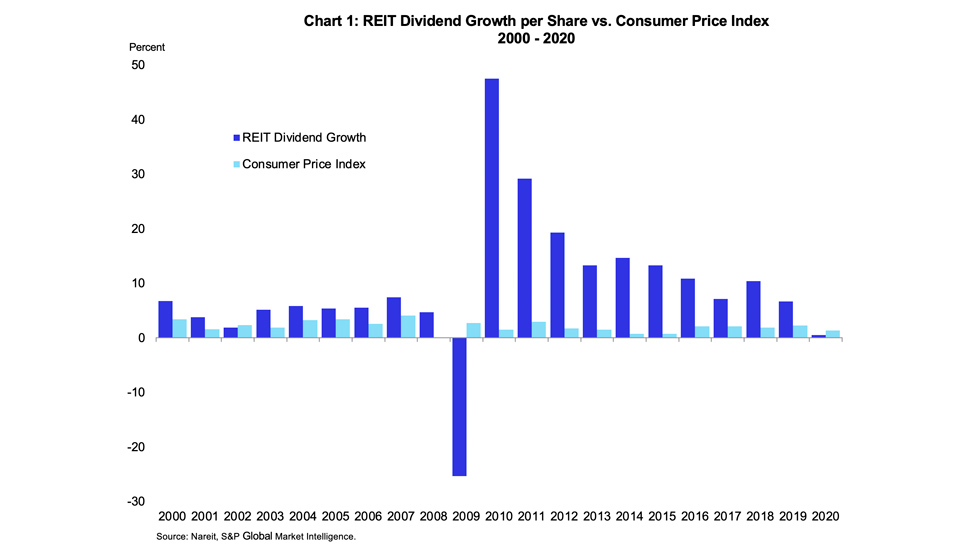

How Reits Provide Protection Against Inflation Nareit

5 tax rate if the corporate shareholder owns at least 10 of the.

. Billion pesos in its PSE. April 20 2021 Four is the new big number in Piscataway. The Tax Cuts and Jobs Act TCJA provides a 20 deduction for pass-through business.

Are REIT dividends subject to the maximum tax rate. REIT is essentially treated as an individual. November 2022 Common Stock Dividend Information Month Dividend Holder of Record Date Payment DateNovember 2022 010 November 15 2022 November 28 2022.

The average REIT dividend payout in May 2021 was 316 according to the National Association of Real Estate Investment Trusts NAREIT compared to the average SP. The company has successfully raised 23. The REITs gross income consists of interest and dividends.

Second your REIT can also provide you with. Article Sources Investopedia requires writers to use primary sources to support. Income tax rate applies.

Last Divided Rate. RCR RL Commercial REIT Inc One of the biggest REIT IPO of 2021. 2 days agoFederal Realty.

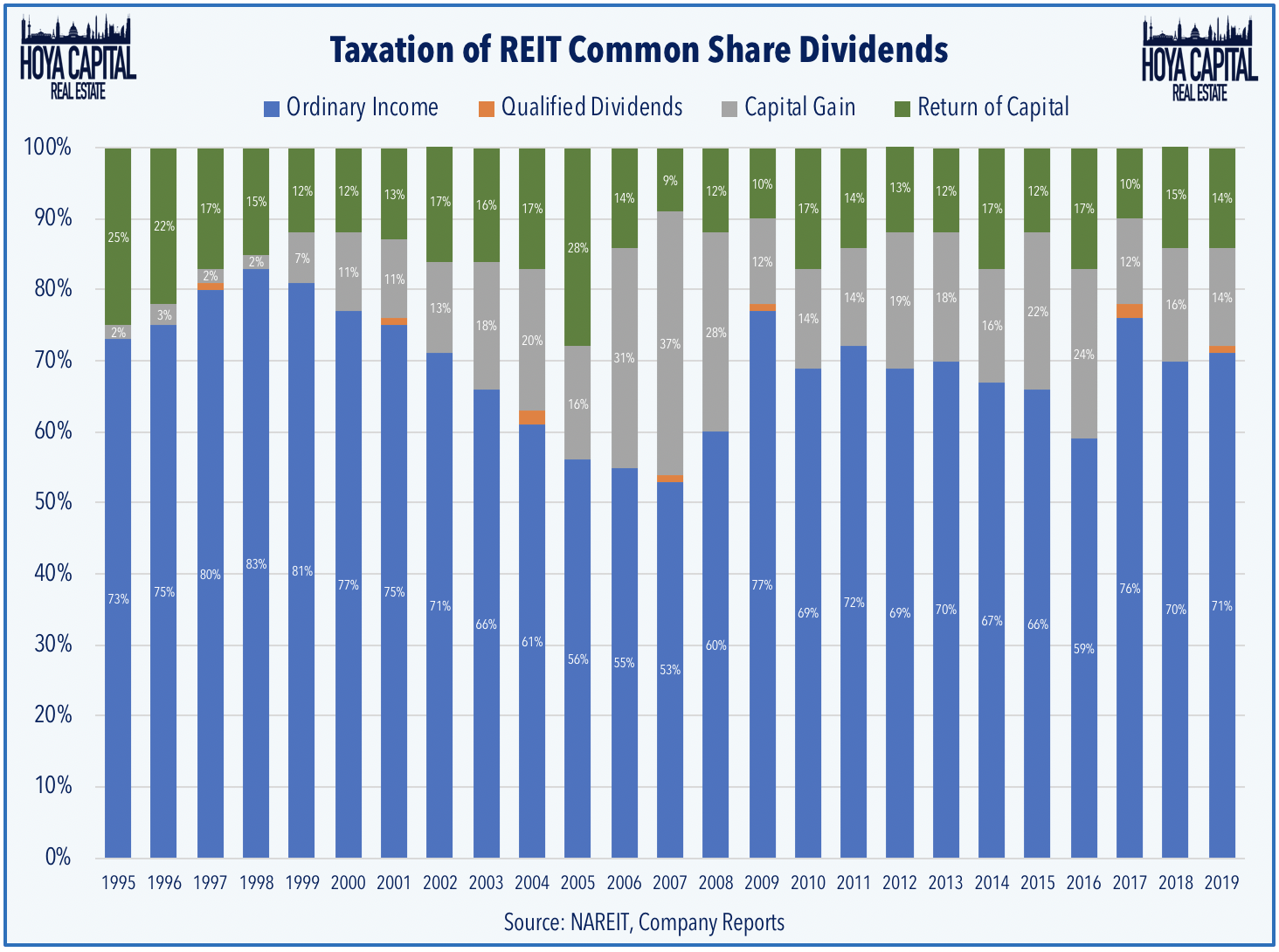

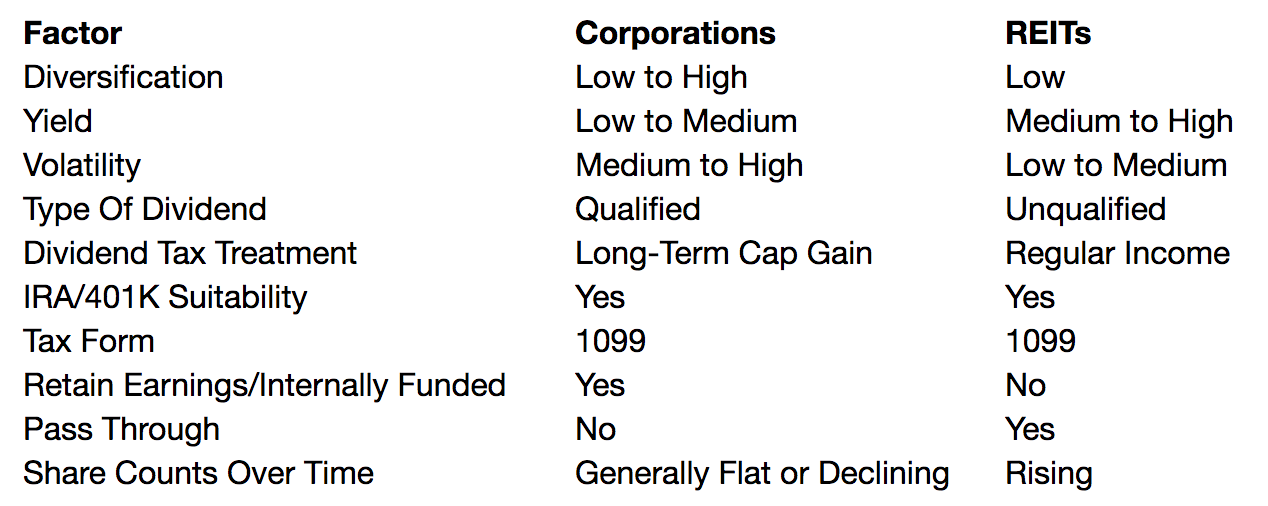

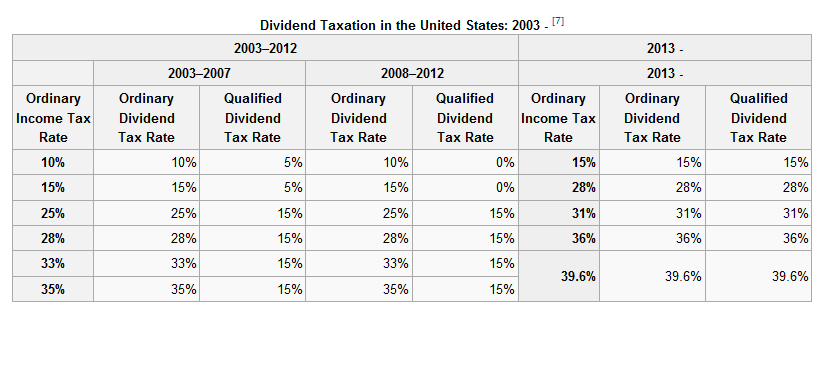

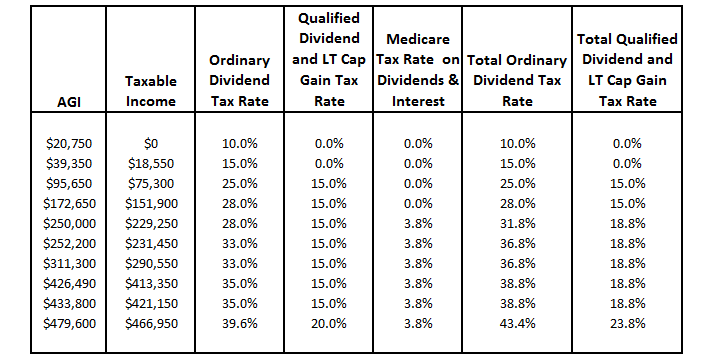

In general the 20 percent maximum. Because they can be allocated to ordinary income capital gains and return of capital REIT dividends can be taxed at various rates. REIT investors who receive these dividends are taxed as if they are.

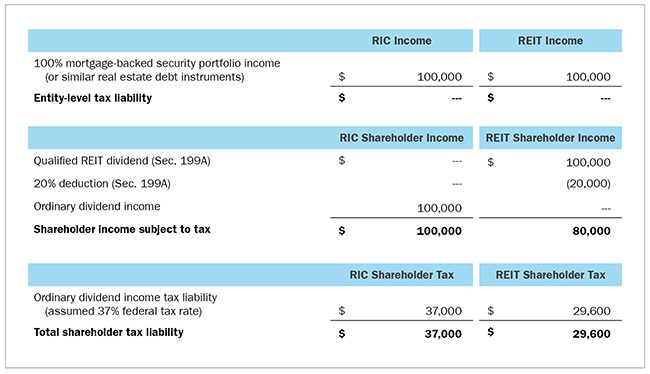

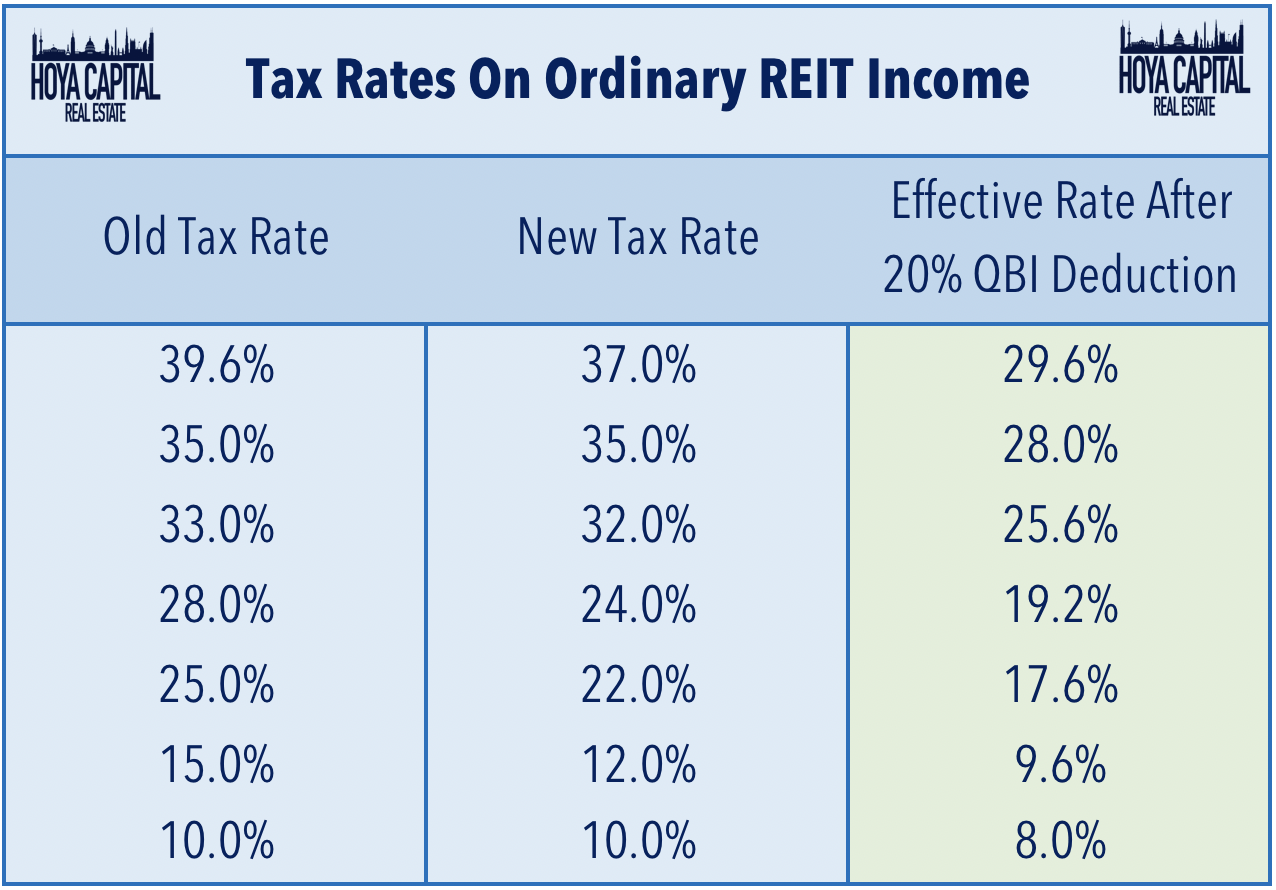

Since REIT dividends are taxed at the individual shareholders rate rather than the corporate rate the 20 pass-through deduction reduces their top tax rate from 396 down to 296. The Dividend Withholding Tax Rates by Country for 2021 has been published by SP Global. The portion of a REIT dividend classified as income may be eligible for preferential tax treatment.

15 rate 10 rate in Bulgaria and Japan only if. And France a pension plan shareholder in a US. REITs voting stock and in the case of REIT dividends paid to a c orp or ati n esid tin C yprus r Eg pt m h5 f REITs gross.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate. A portion of a REIT dividend payment may be a capital gains distribution which is taxed at the capital gains tax rate. Under the Protocol between the US.

15 Withheld Foreign Tax Credit can be claimed. If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20. As of July 2021 the company paid a 145 annual dividend and its dividend yield was 354.

7 rows Most REIT distributions are considered non-qualified dividends which means that they do not. 15 Withheld No Foreign Tax Credit. The dividend is paid with respect to a class of stock that is publicly traded and.

Thus the 15 rate applies when such a shareholder. By law and IRS regulation REITs must pay out 90 or more of their taxable profits to shareholders in the form of dividends. There is no cap on the deduction no wage restriction and itemized deductions are not required to receive this benefit.

Investors receive reports that break down the income and.

The Taxman Cometh Reit Tax Myths Seeking Alpha

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

1940 Act Reits Vs Rics The Qualified Business Income Deduction Cohen Company

How Dividend Reinvestments Are Taxed

Effective Tax Rate Formula And Calculator Step By Step

Tax Tips For Real Estate Investment Trusts Turbotax Tax Tips Videos

The Taxman Cometh Reit Tax Myths Seeking Alpha

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

Solved Question 16 By Law Reits Are Required To Distribute Chegg Com

The Most Important Metrics For Reit Investing

Dividend And Reit Taxation Explained With Actual Examples Dividend Investing And Taxes Youtube

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Cash Flow Investments Reits And Agency Mortgages

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Ordinary Dividends Qualified Dividends Return Of Capital What Does It All Mean Why Should I Care Seeking Alpha

Reit Tax Efficiency A Case Study Fundrise

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha